Issue #50 - Extended energy bill support 💡

How will the Energy Bills Discount Scheme work? | How to complete your small business tax return | Can you claim back VAT on business energy? | 5 businesses, 1 question | Words | Tunes | More

🦾 G O

Energy bill support announced - but how will it work? 🤔

Welcome to Issue #50 of The Backbone - the fortnightly newsletter from Bionic.

The government has announced a replacement support package that will kick in when the Energy Bill Relief Scheme ends in March. The Energy Bills Discount Scheme sounds and works a bit like the previous scheme, but support is tiered and not quite as generous.

Here’s all you need to know…

The Energy Bills Discount Scheme will run from April 1, 2023, to March 31, 2024, and will offer the following discounts to most businesses:

Gas – A maximum of £0.00697 (about 0.7p per kWh) off the difference between the wholesale element of the unit rate you pay to your supplier and the price threshold of 10.70p per kWh.

Electricity - A maximum of £0.01961 (about 2.0p per kWh) off the difference between the wholesale element of the unit rate you pay to your supplier and the price threshold of 30.20p per kWh.

The discount will be applied automatically to eligible non-domestic gas and electricity contracts. This includes fixed contracts agreed on or after December 1, 2021, as well as deemed, out of contract, standard variable tariffs.

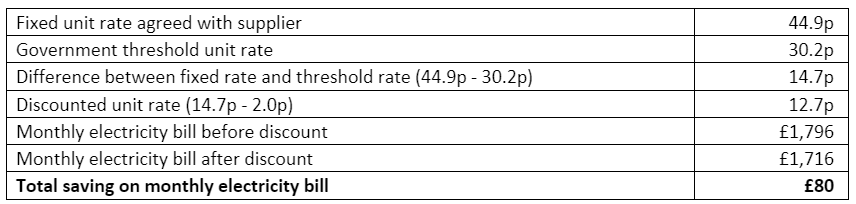

If you’re wondering how much of a discount that amounts to, we’ve crunched the numbers on the government example of a pub that uses 16 MWh of gas and 4 MWh of electricity each month. Here’s how its electricity bills could be discounted…

Note: The figures shown are based on the average gas and electricity unit rates quoted by Bionic for a microbusiness from January 3 to January 6, 2023. For more details, check out our blog on business energy prices.

It’s also worth noting that the discount will be only applied when the wholesale part of your unit rate is higher than the government threshold rate (30.2p per kWh in the example above). And you may not get the full discount if your rate reaches the maximum for that fuel (2p per kWh in the example above) before it can be applied.

For example, if the wholesale part of your unit rate is 31.2p per kWh hour, then you’ll only get a 1p discount as your rate will have reached the government threshold unit rate before the full 2p discount can be applied.

If your business falls into the Energy Trade Intensive Industries category (there's a full list of qualifying Energy Trade Intensive Industries on the government website), then the scheme works a little differently. To find out more, check out our guide to the Energy Bills Discount Scheme.

📨 S U B S C R I B E

Subscribe to The Backbone to get each fortnightly edition into your inbox at 7 am every other Friday. Perfect for a quick read at breakfast or on the commute.

🗞 R E A D

How to complete your small business tax return

January 31 is the tax return deadline for the 2021 to 2022 tax year. If you’ve left it until now to sort your tax returns, you could have a busy couple of weeks coming up. To help make tax returns as straightforward as possible, we’ve put together this helpful guide that covers everything you need to know about UK tax returns.

Can you claim back VAT on business energy?

You might not realise it, but if your business is VAT registered, then you should be able to recover the VAT as input tax on your business expenses, subject to the normal VAT deduction rules. This applies regardless of whether you pay the 20% VAT rate or the reduced rate of 5%. Find out all you need to know about VAT and energy bills in this guide.

🗣 S H O U T O U T

#BionicBusinessStory - 5 businesses, 1 question 🤔

We love hearing all about how small business owners got to where they are. The stories of how they’ve built their business, the things that keep them awake at night, their biggest achievements, and how they cope when life feels like it’s going at 100 miles an hour. We asked five business owners one simple question, and here’s how they answered…

Bionic - What is your biggest barrier as a business owner?

🐩 “Copyright infringements. I suppose it’s quite flattering in some ways, but it does frustrate me as a business owner. I just try and keep changing and improving my designs all the time.” Lilly Shahravesh - LISH

🍖 “I would say the only barrier is working within someone else’s family-run business. Sometimes disagreements can be brought into work which can cause a bit of tension, especially as you’re not directly involved.” Drew Stagg - Potter’s Butchers

🎨 “Confidence in my quality of work. Art can be so subjective, as can the merchandising that goes along with it.” Jillian Kelshaw - Jillian Kelshaw Art

💅 “When we first created our face masks, it was difficult trying to convince people they worked the same as the ones you’d pay for at a specialised clinic.” Farrah Allarakha - NeoElegance

🐶 “I think the biggest thing for me is sometimes you can put on these events and people don’t necessarily see all the hard work that’s gone into it.” Marcus Akford - Pup Up Café

Want to read more small business stories? Head over to Bionic 🦾

📩 J O I N

Get involved with our business community 🔊

Share your thoughts and tips to give other busy business owners a helping hand. Or ask a question to see if anyone can help you out.

📊 B U S I N E S S

Get your business costs sorted 💷

Bionic - the business price comparison experts - compare a range of business essentials to help you save time, money, and hassle.

Our tech-enabled team will answer all your questions in simple terms, and help you find the best deal on business energy, insurance, phone, broadband, or finance. No jargon. No-fuss. #BeABionicBusiness 🦾

Bionic made plans for Nigel’s new electricity contract so he could get back to running his pub 🍻

Check out more ⭐⭐⭐⭐⭐ Trustpilot reviews

🎧 L I S T E N

Playlist 🎶

EQUAL: Classical compiles classical tracks from women composers and is the perfect playlist for any situation, whether you’re typing away at your laptop, serving coffee, cutting hair, or relaxing after a long day.

Podcast 🔊

Everybody loves Martin Lewis. The apolitical people’s champion has been dishing out money-saving advice for more than a decade, and it seems that advice is more important than ever, as the cost of living crisis doesn’t look like it’s going away any time soon. You can check out all his prudent pointers on The Martin Lewis Podcast.

👩🤝👩🏾 S H A R E

If you love The Backbone (or even if you just quite like it) share it with someone who has equally great taste in email newsletters.

🏡 H O U S E K E E P I N G

Check your folders 📁

If The Backbone isn’t landing in your inbox every other Friday, please mark this address as ‘not spam.’ If it isn’t in your spam folder, it may have been moved to another folder, like ‘Promotions’ or ‘Social’.

🚫 S T O P

Thanks for making it to the end of another Bionic small business bulletin 🤝🏻

Please leave a comment and let us know if there’s anything else we should be featuring.

And don’t forget to send this link to all your friends and get them to subscribe ✌🏻