2024 Autumn Budget Special 💷

💼 All the relevant Autumn Statement announcements for SMEs, including, National Insurance Contributions, business rates, Inheritance Tax, fuel duty, income tax, VAT, and more.

🦾 GO

💼 2024 Autumn Budget for SMEs

Bionic rounds up the most relevant bits of the 2024 Spring Budget so you know exactly what to expect.

We’re just reporting the facts, we’ll leave it up to you to decide whether the Chancellor’s plans go far enough. You can read more on the announcements at our blog - Autumn Statement round-up for busy business owners.

🤒 National Insurance Contributions

As expected, there’ll be no change to employee National Insurance Contributions (NICs), but employers will see their NICs increase by 1.2 percentage points - from April 2025 it will increase from 13.8% to 15.0%.

The secondary threshold (the point at which employers start paying NICs on employee's earnings) has been cut from £9,100 to £5,000.

To try and lessen the impact on smaller businesses, the Employment Allowance will increase from £5,000 to £10,500. This will mean an estimated 865,000 employers will pay no NICs next year. It’s also estimated that a further 1 million employers will pay the same as or less than previously.

🏪 Business rates

Business rates are taxes on property used for business purposes, such as offices, shops, pubs, and warehouses. You can check out the government website for more information on business rates.

Business rates are calculated by using a multiplier. The rateable value of your business property is multiplied by this number to give you your final bill. If the rateable value of your property is below £51,000, your bill will be calculated using the small business multiplier. This mutliplier has been frozen.

The Retail, Hospitality and Leisure business rates relief scheme, which offers a 75% relief on business rates, will end in April 2025. It will be replaced by a discount of 40%, up to a discount of £110,000.

Go to the government's website to work your business rates.

🏪 Corporation Tax

No change to corporation tax was announced.

If your company has profits of £50,000 or less, you’ll pay a small profits rate (SPR) of 19%. Any profits between £50,000 and £250,000 will be charged at a higher rate of 25%. Marginal relief is offered to make this an incremental increase to soften the impact.

Full capital expensing for businesses will stay in place. This means that every £1 a company invests in IT, plant or machinery can be deducted in full from taxable profits.

💷 Income Tax

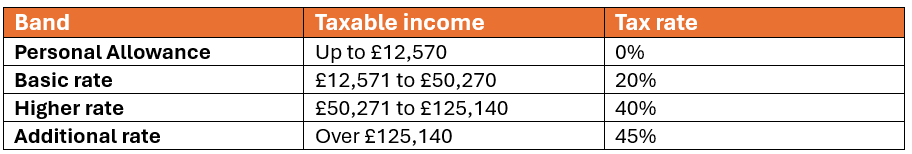

There will be no extension of the freeze in income tax thresholds beyond the decisions of the previous government. This means the current rates (below) will be frozen until 2028.

From 2028/29, personal tax thresholds will be uprated with inflation.

📈 VAT

There are no changes to VAT. This means the standard rate of VAT will be 20%, with a reduced rate of 5%. The VAT registration threshold (the point at which businesses need to pay VAT on taxabale turnover) will remain at £90,000.

📨 S U B S C R I B E

Subscribe to The Backbone to get each fortnightly edition into your inbox at 7 am every other Friday. Perfect for a quick read at breakfast or on the commute.

🤝 Inheritance Tax

No inheritance tax on the first £1 million of combined business and agricultural assets. For assets of over £1 million, Inheritance Tax will apply with a 50% relief and at an effective rate of 20%. This is designed to protect small family farms.

The 50% relief will also apply to shares on AIMs and other similar markets. AIM was created to help smaller or riskier companies have access to capital via the public markets.

🏦 Capital gains tax

If you sell assets at a profit, such as a second home or investments, including shares, you’ll be charged capital gains tax on the money you make.

The lower rate of Capital Gains Tax will rise from 10% to 18%, and the higher rate from 20% to 24%.

The rates on residential property will remain at 18% and 24%.

Asset Disposal Relief will stay at 10% on all qualifying assets until April 2025, when it will increase to 14%. From April 2026 it will increase to 18%. The lifetime limit asset disposal will stay at £1 million.

💷 Wages

The national living wage - the minimum amount that can be paid to workers who are 21 and over - will rise by 6.7% from April 2025, when the following will apply:

£12.21 per hour for employees aged 21 and over

£10.00 per hour for employees aged 18-20

£7.55 per hour for employees aged under 18

£7.55 per hour for apprentices

👩🤝👩🏾 S H A R E

If you love The Backbone (or even if you just quite like it) share it with someone who has equally great taste in email newsletters.

🤔 Anything else?

The chancellor announced some other measures that will be of interest to some business owners.

Fuel duty will be frozen for another year and the 5p cut in fuel duty will also be extended for another 12 months.

Alcohol duty rates on draught products will be cut by 1.7%. This will amount to a penny off the price of a pint. Alcohol duty rates on non-draught products will increase in line with RPI from February next year. Check out the government's website for a full rundown of the current alcohol duty rates.

The tobacco duty escalator (which increases the duty rate on tobacco products by a percentage above the Retail Price Index (RPI) inflation rate) will be renewed at the Retail Price Index (RPI) +2%. Duty on hand-rolling tobacco will go up by 10%. A flat-rate duty on all vaping liquid will be introduced from 2026, and a one-off increase in tobacco duty to maintain the incentive for smokers to give up smoking.

The UK’s windfall tax on the profits of oil and gas companies will be increased from 35% to 38% and will run until March 2030.

📊 BUSINESS

Get your business costs sorted 💷

Our tech-enabled team will answer all your questions in simple terms, and help you find the best deal on business energy, insurance, phone, broadband, or finance. No jargon. No-fuss. #BeABionicBusiness 🦾

🔥 HASHTAG

If you want to hear more from us, check out our Twitter, Facebook, Instagram, and LinkedIn feeds.

Get involved by using the hashtags #BeABionicBusiness and #BionicBusinessStory.

🗯 COMMUNITY

Join our community of small business superheroes

Small business owners are the superheroes of the high street. But small business owners rarely get their voices heard. Now there’s a place where they can chat, share advice, and help each other through the lows and highs of running a business. To get involved, scan or click the QR code above or click the button below to leave us your email address.

We’ll be back with Issue #95 of The Backbone on Friday, November 1 🎆