2023 Spring Budget Special 💷

💼 All the relevant Spring Budget announcements for SMEs, including energy, fuel duty, National Insurance contributions, business rates, income tax, VAT, and more.

💼 2023 Spring Budget for small business owners

Bionic rounds up the most relevant bits of the 2023 Spring Budget so small business owners know exactly what to expect.

These things are usually pretty divisive, so we’re just going to report the facts about those bits that relate to business. We’ll leave you to decide whether it was a good Budget for you. For more in-depth details, check out our blog - Spring Statement round-up for busy business owners.

💡 Energy

As expected, the Energy Bills Discount Scheme (EDBS) will replace the Energy Bill Relief Scheme (EBRS) from April 1. This will discount the unit rates on all eligible non-domestic gas and electricity contracts for the next 12 months.

You can find out exactly how it works in our guide to the Energy Bills Discount Scheme or by watching the video below.

The key things to remember are that this is not a price cap and that funding for EBDS will be capped at £5.5 billion over 12 months – that's a significant cut from the £18 billion put aside for the six months of EBRS. That’s why it makes sense to compare business energy quotes to see if you could save more by fixing your rates.

🤒 National Insurance Contributions

As outlined in the 2022 Autumn Statement, National Insurance thresholds will stay the same until 2028.

To recap, this means that:

Employees won't pay anything in National Insurance Contributions (NICs) until they're earning £12,570 a year.

Employers pay NICs at a rate of 13.80% for all employees that earn more than £8,840 per year (excluding those aged 21 or under and apprentices aged 25 or under).

The Employment Allowance will stay at £5,000 until March 2026. This means eligible employers can cut their employer NICs bills by up to £5,000 per year, a tax cut worth up to £1,000 per employer.

If you’re self-employed and pay "Class 4" rates, you’ll pay 9.73% on profits between £11,909 and £50,270 and 2.73% on profits over £50,270.

📨 S U B S C R I B E

Subscribe to The Backbone to get each fortnightly edition into your inbox at 7 am every other Friday. Perfect for a quick read at breakfast or on the commute.

🏪 Business rates

Business rates will be reevaluated on April 1. This means your business rates will be based on the Valuation Office Agency’s (VOA) estimate of your property’s open market rental value on April 1, 2021. You can get an estimate of your property’s 2023/24 rateable value at the government website.

From April 6, the 2023/24 Retail, Hospitality and Leisure business rates relief scheme will give eligible properties a 75% relief on business rates, up to a cash limit of £110,000 per business.

You can find out more about eligibility and see some examples of how much different business properties save on the government website. One thing to note is that the eligibility section will talk about ‘hereditaments’ - in this context, it just means a business property or a property that’s not classed as domestic (such as one that’s occupied by a charity).

📈 Corporation tax

The main rate of corporation tax will increase from 19% to 25% from April 6. This higher rate will be paid by limited companies on profits over £250,000 made from trading and from the sale of assets or investments.

If your company has profits of £50,000 or less, you’ll pay a small profits rate (SPR) of 19%.

Any profits between £50,000 and £250,000 will be eligible for marginal relief. This means there will be a gradual increase between the small profits rate and the main rate, so you’re not hit with the full 25% rate. You can calculate marginal relief for corporation tax on the government website.

The ‘super-deduction’ will end on March 31 and will be replaced with full capital expensing for the next three years. This means that every £1 a company invests in IT, plant or machinery can be deducted in full from taxable profits.

👷♀️ Annual investment allowance

The annual investment allowance (AIA) provides 100% tax relief on certain assets and is designed to encourage people to invest in growing their businesses. AIA includes most plant and machinery but excludes cars, items you owned for another reason before you used them at your business or items given to you or your business.

The maximum claim amount of £1 million will continue past April 2023.

💷 Dividend tax

The following dividend tax rates will apply from April 6:

Ordinary rate – 8.75%

Upper rate – 33.75%

Additional rate – 39.35%

Your income tax band dictates the rate of tax you pay on dividends above the allowance. From April 6, this allowance will be cut from £2,000 to £1,000. It will then be cut to £500 from April 2024.

🏦 Capital gains tax

Capital gains tax is a tax on assets that have increased in value. If you’ve had an asset for more than a year and its value has gone up, you’ll be charged capital gains tax when you sell it.

From 6 April 2023, the capital gains tax-free annual allowance will be cut from £12,300 to £6,000, then to £3,000 from April 2024.

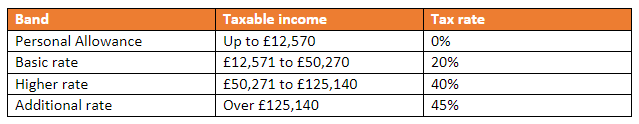

💸 Income Tax

Income tax is a tax you pay to the government based on your yearly income. This tax goes towards funding public services, including the NHS and schools, as well as social security, such as universal credit and the state pension. The 2023/24 income tax rates are:

💷 Wages

As announced in the Autumn 2022 budget, from April 1, the following National Living Wage rates will be as below:

£10.42 for employees aged 23 and over

£10.18 for employees aged between 21 and 22

£7.49 for employees aged 18 to 20

🤔 Anything else?

The chancellor announced some other measures that will be of interest to some business owners.

£63m fund for public pools and leisure centres.

£100m fund for local charities and community organizations.

Beer and other draught products in pubs will be 11p cheaper than in supermarkets. This drop in duty - labelled as the “Brexit Pubs Guarantee” - will take effect from April 1.

There will be a new tax credit for small and medium-sized firms that spend 40% of their expenditure on research and development (R&D) as well as tax reliefs for film, TV and video gaming businesses.

Theatres, Orchestras, and museums will have tax reliefs extended for two years.

📊 B U S I N E S S

Get your business costs sorted 💷

Our tech-enabled team will answer all your questions in simple terms, and help you find the best deal on business energy, insurance, phone, broadband, or finance. No jargon. No-fuss. #BeABionicBusiness 🦾

🔥 H A S H T A G

If you want to hear more from us, check out our Twitter, Facebook, Instagram, and LinkedIn feeds.

Get involved by using the hashtags #BeABionicBusiness and #BionicBusinessStory.

📩 J O I N

Get involved with our business community 🗣

Share your thoughts and tips to give other busy business owners a helping hand. Or ask a question to see if anyone can help you out.

We’ll be back with Issue #54 of The Backbone on Friday, March 17 ☔