2023 Autumn Statement Special 💷

💼 All the relevant Autumn Statement announcements for SMEs, including energy, National Insurance, business rates, income tax, pensions, R&D, wages, and more.

🦾 GO

💼 2023 Autumn Statement for SMEs

We’ve rounded up the most relevant bits of the 2023 Autumn Statement so you know exactly what to expect.

We’re just reporting the facts, so it’s up to you to decide whether the plans the Chancellor is ringing in are good or bad for business.

For a more detailed look at the announcements, check out our blog - Autumn Statement round-up for busy business owners.

💡 Energy

The Energy Bills Discount Scheme is set to end on March 31, 2024. There’s been no announcement from the government regarding further support after this date. Remember, this scheme is not a price cap. Instead, it offers a discount on gas and electricity for qualifying non-domestic contracts.

The energy market has been a lot less volatile this year, and prices have largely been coming down since they peaked in late 2022. But wholesale prices are still around twice as much as they were at the start of 2021 and suppliers' out-of-contract rates are on average about 40% higher on non-domestic contracts.

If your current contract is coming up for renewal, it still makes sense to compare business energy prices to find the cheapest possible fixed rates.

The current price cap on domestic energy was cut from £1,976 to £1,834 for the period from October 1 to December 31. An announcement on the rate for January 1 to March 31, 2024, is due tomorrow (November 23).

Energy consultancy Cornwall Insight expects Ofgem to announce a 5% rise to push the cap back up to £1,931 for a typical dual-fuel household. The regulator is also considering a further adjustment to the cap to help stop suppliers going bust. This could see a further increase in domestic bills, but this isn’t expected until April 2024.

🤒 National Insurance Contributions

If you’re self-employed, there are changes to both "Class 2" and "Class 4" rates, which will kick in from April :

"Class 2" National Insurance paid by self-employed people earning more than £12,570 will be scrapped. That will get rid of a flat rate compulsory charge of £3.45 a week.

"Class 4" National Insurance will be cut from 9% to 8%. This is payable on profits between £12,570 and £50,270. It will stay at 2.73% on profits over £50,270.

📨 S U B S C R I B E

Subscribe to The Backbone to get each fortnightly edition into your inbox at 7 am every other Friday. Perfect for a quick read at breakfast or on the commute.

🏪 Business rates

Business rates are a tax on property used for business purposes, such as offices, shops, pubs, and warehouses. You can check out the government website for more information on business rates.

Business rates are calculated by using a multiplier. The rateable value of your business property is multiplied by this number to give you your final bill. If the rateable value of your property is below £51,000, your bill will be calculated using the small business multiplier. This is lower than the standard multiplier and the Chancellor announced this will be frozen for another year.

The Retail, Hospitality and Leisure business rates relief scheme will be extended for another year. This gives eligible properties a 75% relief on business rates, up to a cash limit of £110,000 per business.

The Chancellor estimates that this will save the average independent shop more than £20,000, and the average independent pub more than £12,800 over the next year.

Go to the government's website to work your business rates.

📈 Corporation tax

The main rate of corporation tax will stay at 25%, payable by limited companies on any profits over £250,000 made from trading and the sale of assets or investments.

If your company has profits of £50,000 or less, you’ll pay a small profits rate (SPR) of 19%. Any profits between £50,000 and £250,000 will be charged at a higher rate of 25%. Marginal relief is offered to make this an incremental increase to soften the impact.

Full capital expensing for businesses has been made permanent. This means that every £1 a company invests in IT, plant or machinery can be deducted in full from taxable profits.

👩🤝👩🏾 S H A R E

If you love The Backbone (or even if you just quite like it) share it with someone who has equally great taste in email newsletters.

🤖 Research and Development tax relief

The Research and Development (R&D) tax relief scheme for SMEs offers support for companies that work on innovative projects in science and technology. This will be merged with the Research and Development Expenditure Credit (RDEC) to cut complexity and encourage more businesses to claim.

Find out more about R&D expenditure credits at the government website.

💷 Dividend tax

As announced in last year’s Autumn Statement, the rate of Dividend Tax will be cut from £1,000 to £500 from April 2024. This means you’ll then pay tax on any dividend income over £500.

🏦 Capital gains tax

If you sell shares at a profit, you’ll be charged capital gains tax on the money you make. If you’re a higher-rate taxpayer, you’ll pay a 20% capital gains tax on profits from shares. The tax-free threshold will be cut to £3,000 from April 2024.

💸 Income Tax

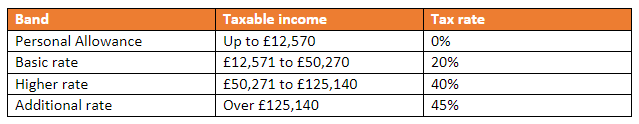

Income tax is a tax you pay on your earnings. It was announced in last year's Autumn Statement that the following rates will be frozen until 2027/28:

The state pension will increase by 8.5% next year and the Chancellor announced a consultation to give "savers a legal right to require a new employer to pay pension contributions into their existing pension so they have just one pension pot". This could bring more admin headaches for business owners.

💷 Wages

The national living wage - the minimum amount that can be paid to workers who are 21 and over - will rise by 9.8% from April 2024, when the following will apply:

£11.44 per hour for employees aged 21 and over

£8.60 per hour for employees aged 18-20

£6.40 per hour for employees aged under 18

£6.40 per hour for apprentices

🤔 Anything else?

The chancellor announced some other measures that will be of interest to some business owners.

Alcohol duty will be frozen until August 1, 2024. Check out the government's website for a full rundown of the current alcohol duty rates.

Tobacco duty has been put up by 10%

£500 million will be invested over the next two years to fund AI innovation centres

£960 million will go to the Green Industries Growth Accelerator for offshore wind and electric networks, nuclear, carbon capture, utilisation and storage (CCUS), and hydrogen technologies

£4.5 billion to attract investment in strategic manufacturing sectors. £2 billion will be invested in zero emissions technology in the auto industry

📊 B U S I N E S S

Get your business costs sorted 💷

Our tech-enabled team will answer all your questions in simple terms, and help you find the best deal on business energy, insurance, phone, broadband, or finance. No jargon. No-fuss. #BeABionicBusiness 🦾

🔥 H A S H T A G

If you want to hear more from us, check out our Twitter, Facebook, Instagram, and LinkedIn feeds.

Get involved by using the hashtags #BeABionicBusiness and #BionicBusinessStory.

🗯 COMMUNITY

Exclusive access to the Small Business Hub 🗣

Small business owners are the superheroes of the high street. But small business owners rarely get their voices heard. Now there’s a place where they can chat, share advice and help each other through the lows and highs of running a business. To get involved, we just need your business email address (we won’t use it for anything else) and we’ll send you an invite.

We’ll be back with Issue #72 of The Backbone on Friday, November 24 🥶